Hei-Hei-Hei!

We are less than 2 years out from the end of the year. So it is getting closer and closer to get all my yearly goals done. Well, this month was great for that, I am not done but moved closer to it significantly. But let's start with the usual.

Firstly deposits/withdrawals:

Envestio 100

Grupeer 100

LHV Growth Account 250

Bondora -10

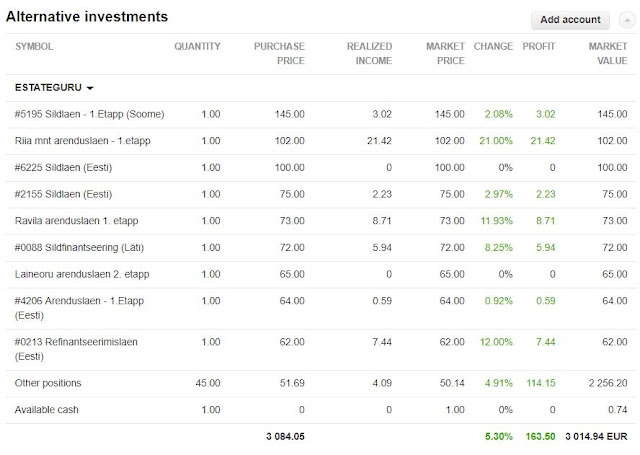

EstateGuru -100

CrowdEstate -250

I kept withdrawing money from the EstateGuru and CrowdEstate due to al the issues with default loans. I also managed to withdraw 10 EUR from Bondora. I have still not decided where to invest this money, together with the last month I have withdrawn 760 EUR. I could add it to one of my other investments or... one simple option would be to add it to our official tax-deferred third pillar pension account. There seem to be changes happening to the account where people joining it later would have less of the tax benefits so maybe I should start it with some money. At the same time, the tax advantage is only present if I access the money above a certain age (it is 55 according to current rules), and I am unlikely to live to that age due to my health condition. Decisions-decisions.

But as I did add investments to other accounts I ended the month with +90€ in investments when looking at all the deposits and withdrawals.

But let's go to the income, as who does not like income numbers:

From best to worst:

119,85 CrowdEstate

95,90 LHV Growth Account

50,33 Mintos

35,73 EstateGuru

21,75 Envestio

9,22 Grupeer

0,08 Bondora

Total 332,86€ or 10,74 a day!

I have to start by stating this was my best month of all time! And it beat the previous best (July 2019) with more than 100€!

So I had several payments in CrowdEstate and that is, of course, hopeful, I did also invest in a few of the new loans. I have been looking at the deadlines of my longest loans on both CrowdEstate and EstateGuru and investing in projects with shorter deadlines so that I am not extending my involvement with the portal above my currents loans there. I might end up selling all and coming out but I have not decided yet. So slowly decreasing the size of the portfolio there but at the moment not going for a quick exit.

A big part of this month's large income was the SPYW (Euro Dividend Aristocrats) dividend I mentioned already last month as I could see it in future payments back then. This gave a nice large boost to my cashflow this month.

This great month also gave a good boost to my yearly goal of 1800 in pre-tax investment income. Last month I was really stressed that I won't make it, but now the future looks better. My income this year has been 1623,56. So in the next two months, I need to earn on average 88€ a month to meet the goal. The most recent month with so low income was November 2018, so I hope that is not a November tradition or something.

But as none of the months this year has been that poor (the lowest was around 100€ mark) I expect to hit my goal before Christmas.

As I have added almost no new money to my investments for the past 2 months my portfolio value has been increasing very slowly, but it is about 525 higher than last month. It was 26357,43 on 31.10.2019.

We are less than 2 years out from the end of the year. So it is getting closer and closer to get all my yearly goals done. Well, this month was great for that, I am not done but moved closer to it significantly. But let's start with the usual.

Firstly deposits/withdrawals:

Envestio 100

Grupeer 100

LHV Growth Account 250

Bondora -10

EstateGuru -100

CrowdEstate -250

I kept withdrawing money from the EstateGuru and CrowdEstate due to al the issues with default loans. I also managed to withdraw 10 EUR from Bondora. I have still not decided where to invest this money, together with the last month I have withdrawn 760 EUR. I could add it to one of my other investments or... one simple option would be to add it to our official tax-deferred third pillar pension account. There seem to be changes happening to the account where people joining it later would have less of the tax benefits so maybe I should start it with some money. At the same time, the tax advantage is only present if I access the money above a certain age (it is 55 according to current rules), and I am unlikely to live to that age due to my health condition. Decisions-decisions.

But as I did add investments to other accounts I ended the month with +90€ in investments when looking at all the deposits and withdrawals.

But let's go to the income, as who does not like income numbers:

From best to worst:

119,85 CrowdEstate

95,90 LHV Growth Account

50,33 Mintos

35,73 EstateGuru

21,75 Envestio

9,22 Grupeer

0,08 Bondora

Total 332,86€ or 10,74 a day!

I have to start by stating this was my best month of all time! And it beat the previous best (July 2019) with more than 100€!

So I had several payments in CrowdEstate and that is, of course, hopeful, I did also invest in a few of the new loans. I have been looking at the deadlines of my longest loans on both CrowdEstate and EstateGuru and investing in projects with shorter deadlines so that I am not extending my involvement with the portal above my currents loans there. I might end up selling all and coming out but I have not decided yet. So slowly decreasing the size of the portfolio there but at the moment not going for a quick exit.

A big part of this month's large income was the SPYW (Euro Dividend Aristocrats) dividend I mentioned already last month as I could see it in future payments back then. This gave a nice large boost to my cashflow this month.

This great month also gave a good boost to my yearly goal of 1800 in pre-tax investment income. Last month I was really stressed that I won't make it, but now the future looks better. My income this year has been 1623,56. So in the next two months, I need to earn on average 88€ a month to meet the goal. The most recent month with so low income was November 2018, so I hope that is not a November tradition or something.

But as none of the months this year has been that poor (the lowest was around 100€ mark) I expect to hit my goal before Christmas.

As I have added almost no new money to my investments for the past 2 months my portfolio value has been increasing very slowly, but it is about 525 higher than last month. It was 26357,43 on 31.10.2019.